News, Articles and Case Studies

Get Updated with Our Insightful Articles and Case Studies.

Stay in the know with our collection of articles and case studies. We provide you with the insights and knowledge to keep you informed on the Mortgage and Insurance Market.

-

Bank Of England Base Rate – February 2026

Bank of England Base Rate Update: February 2026 The Bank of England has confirmed its latest interest rate decision for February 2026, and while there was plenty of debate behind the scenes, the headline outcome is simple: the Base Rate has been held at 3.75%. If you have a mortgage, are thinking about buying a… Read more

-

Inflation – December 2025

Inflation – December 2025 At a glance Inflation moved slightly higher in December, ending the year with prices rising faster than they were in November. While the increase is modest, inflation remains well above the Bank of England’s long-term target of 2%, which means the cost of everyday living is still a real issue for… Read more

-

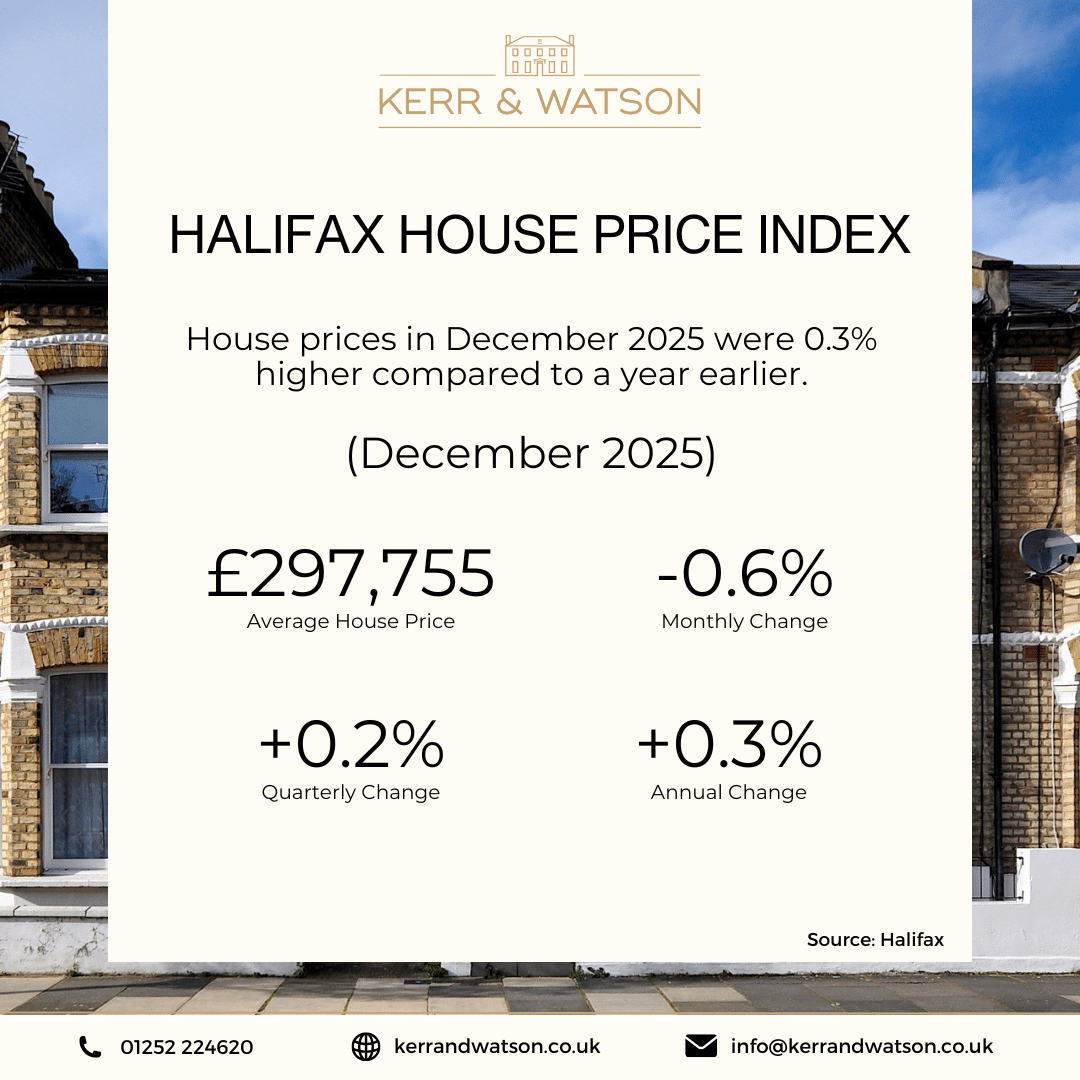

Halifax House Price Index December 2025

House prices in December 2025 were 0.3% higher compared to the same month a year earlier. The latest Halifax House Price Index for December 2025 gives you a clear snapshot of how the housing market finished the year. Prices edged down again, growth slowed, and activity remained fairly steady despite ongoing affordability pressures. If you… Read more

-

Joint Life Insurance vs Two Policies

Joint Life Insurance or Two Policies? Expert Advice for Couples When you’re building a life with someone, there’s a lot to think about, shared finances, future plans, and protecting each other should the worst happen. Life insurance often comes up in those conversations, and one of the first questions you might face is whether to… Read more

-

Bank Of England Base Rate – December 2025

Bank of England Base Rate Update: December 2025 The Bank of England has announced a change to the base rate in December 2025, and this matters because it affects mortgages, savings, loans and the wider cost of living. If you have a mortgage, are thinking about buying a home, or are due to remortgage, this… Read more

-

Re-bridging To A New Bridging Loan

Should You Rebridge To A New Bridging Loan Or Refinance Another Way When you first took out your bridging loan, you probably had a clear plan. You expected to sell, refinance, or complete works within a set timeframe. Then life happened. A sale fell through, builders ran late, planning dragged on, or the mortgage you… Read more

-

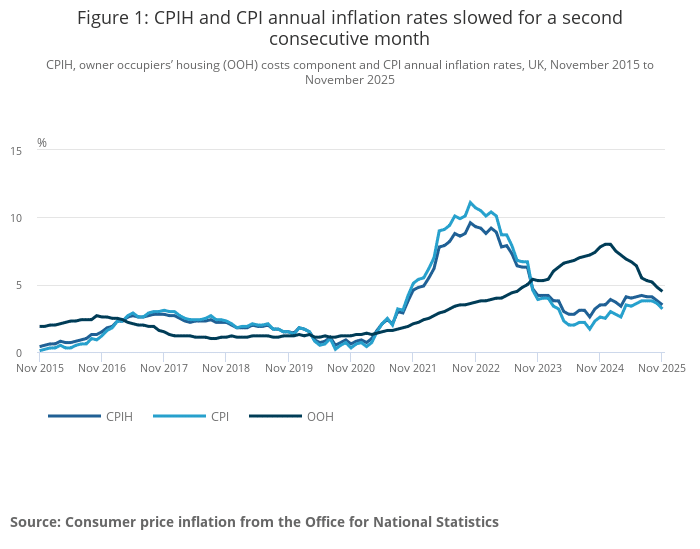

Inflation – November 2025

Inflation – November 2025 At a glance Inflation cooled again in November 2025, and that matters because it affects the cost of everyday life and, indirectly, the direction of interest rates. The main measure most people follow is the Consumer Prices Index (CPI). In simple terms, CPI tracks how much prices are rising (or falling)… Read more

-

UK Commercial Mortgage for Expats and Foreign Nationals

Commercial Mortgages for Expats & Overseas Buyers UK If you are living abroad or moving from overseas and want to invest in property, you may be wondering how to secure a commercial mortgage. For expats and foreign nationals, arranging this type of finance can be more complex than a standard mortgage. Lenders often see international… Read more

-

Case Study: Product Transfer for Rate Renewal

The Scenario An applicant approached us to manage a product transfer as their fixed-rate mortgage was nearing its expiration. The property, based in Hook, Hampshire was valued at £890,000 (NatWest valuation: £838,805), had two mortgage parts with NatWest: The applicant preferred to secure a five-year fixed rate for Part 1 of the mortgage to gain… Read more

-

Life Insurance on weight loss jabs

Does Weight Loss Jabs Affect Life Insurance Cover If you are using weight loss jabs such as Ozempic or Mounjaro, it is completely normal to wonder how it affects your life insurance. You might be taking medication to support weight management, to improve blood sugar control, or as part of a wider plan recommended by… Read more

-

Budget 2025

Budget 2025: What Property Owners, Buyers and Landlords Need to Know Budget 2025 introduces several changes that directly influence property owners, landlords and anyone planning to buy a home. These measures range from council tax reforms to adjustments in savings rules that may shape how you prepare for a deposit or manage ongoing costs. Understanding… Read more

-

Secured Loans & Second Charge Mortgages

Secured Loans Advice for Homeowners If you’re looking to borrow a larger amount, spread repayments over time, or unlock equity in your property without disturbing your current mortgage, a secured loan could be an option, subject to professional advice. A secured loan, sometimes called a homeowner loan or second charge mortgage, lets you borrow money… Read more

-

Inflation – October 2025

Inflation – October 2025 At a glance Inflation continued to edge down in October, offering a small sign of progress while still keeping household budgets under pressure. The Consumer Prices Index (CPI) fell to 3.6% in the year to October, down from 3.8% in September. Although this is a step in the right direction, CPI… Read more

-

Chain Break Bridging Loan

How a chain break bridging loan can save your property purchase When you find the right home, you do not want a broken property chain to ruin everything. Yet buyers pull out, mortgage offers get delayed and sometimes people simply change their minds. This can cause the process to be very stressful. A chain break… Read more

-

Case Study: Supporting First-Time Buyers with a Long-Term Mortgage Solution

The Scenario In Blackwater, Camberley, Surrey, a young professional couple embarked on the exciting journey of purchasing their first home. Both employed and earning a combined annual income of £90,000, they were looking to secure a flat with a purchase price of £230,000. Their deposit, accumulated through savings, amounted to £23,000, leaving a loan requirement… Read more

-

Halifax House Price Index October 2025

House prices in October 2025 were +0.6% higher than the same month a year earlier. If you keep an eye on the property market or you are thinking about moving, the latest Halifax House Price Index gives you a good feel for what is happening right now. The newest figures show that prices have picked… Read more

Adverse Credit Affordability BOE Bridging Loan Bridging Loan Cost Broker Firm of the Year (up to 10 advisers) Buy To Let Commercial mortgage Deposit Equity Release Expat Family Gifted Deposits Farnborough Farnham first time buyer Fixed Rate Foreign National Further Advance High Net Worth HMO Home Improvements Home Mover House Prices HSBC Inflation Inheritance tax Interest only Interest Rates Joint Borrower Sole Proprietor Large Mortgage Life Insurance Limited Company Buy to Let Mortgage Application Mortgage Introducer ONS Overdraft Pre-existing Condition Product Transfer Remortgage Self-Employed Shared Ownership Skipton Building Society Stamp Duty Transfer of Equity UAE

Why Kerr & Watson?

Understanding

We take the time to understand your situation so that we can search for the perfect mortgage and insurance for you. Any recommendation made is completely bespoke to your circumstances.

Experience

Mortgage and insurance advice is our speciality. We have decades of combined experience giving us the knowledge to overcome challenges and find the perfect solution for your needs.

Communication

We work around your schedule to arrange a mortgage or insurance policy that suits your needs. You’ll be kept updated throughout the entire process with clear communication so you’ll always know what’s going on.

Testimonials

Contact Us

Get A Free Consultation – Find out your options by speaking to a mortgage or insurance broker today.

By clicking on ‘Submit’, you consent to your contact details being stored by us and agree with our Privacy Policy.

Kerr & Watson | Address: Pembroke House, 8 St Christophers Pl, Farnborough GU14 0NH, UK | Phone: 01252 224620 | Email: info@kerrandwatson.co.uk | Hours: Mon-Fri 9:00–17:30