News, Articles and Case Studies

Get Updated with Our Insightful Articles and Case Studies.

Stay in the know with our collection of articles and case studies. We provide you with the insights and knowledge to keep you informed on the Mortgage and Insurance Market.

-

Mortgage Illustration

Mortgage Illustrations and Understanding Your Options When looking to purchase or refinance a property, understanding your mortgage options is of extreme importance. A tool in doing so is the mortgage illustration. This document provides a detailed breakdown of your potential mortgage, helping you make informed decisions before being committed. At Kerr & Watson, we aim Read more

-

Getting a Mortgage on a Zero-Hour Contract

How to Secure a Mortgage on a Zero-Hour Contract At Kerr & Watson, we understand that securing a mortgage can be challenging, especially for those on zero-hour contracts. Despite the flexibility and freedom that zero-hour contracts offer, they can complicate your ability to find a willing lender. However, with the right guidance and approach, obtaining Read more

-

Remortgage After A Bridging Loan

Bridging Loan to Mortgage: A Guide to Remortgaging The transition from a bridging loan to a traditional mortgage can be a complex but necessary step. Bridging loans, while essential for securing quick funds, often come with high interest rates and short repayment periods. Remortgaging can provide a more stable and affordable long-term solution. At Kerr Read more

-

First Time Buyer Interest Only Mortgages

Interest-Only Mortgages for First-Time Buyers: What You Need to Know As a first-time buyer, the mortgage market can feel overwhelming at times, especially when considering less conventional options like interest-only mortgages. While these types of mortgages were once more popular, they still provide a viable route for specific situations. Understanding how they work, the eligibility Read more

-

Case Study: Commercial Mortgage for 46 Flats

The Scenario: A Strategic Acquisition A property investor approached us with an ambitious plan: to purchase a substantial block of 46 residential flats, with a total property value of £11.2 million. His strategy was ownership within a limited company, allowing for asset ring-fencing. The investor was not relying on personal capital for the deposit. Instead, Read more

-

Case Study: Bridging Loan Secured After Chain Break for Hampstead Purchase

The Scenario A couple were in the process of buying their dream home in Hampstead, but just before completing, their buyer pulled out of the sale of their current property in Richmond. Without the sale proceeds, they risked losing the Hampstead home, which they had already secured at £7.8 million. They needed a short-term finance Read more

-

UK Mortgages for Overseas Investors

How Overseas Investors Can Secure UK Mortgages Investing in UK property is an attractive option for many overseas investors. The market’s reputation for stability and potential returns has made it a favourite among global buyers. However, securing a mortgage as an overseas investor comes with its challenges. At Kerr & Watson, we specialise in guiding Read more

-

First Time Buyer Mortgage Advisor

Embarking on the journey of purchasing your first home is an exciting but often overwhelming experience. With many factors to consider, from mortgage rates to deposit schemes, the process can seem daunting. That’s where a First Time Buyer Mortgage Advisor comes in – your compass in the complex world of homeownership. The Mortgage Process as Read more

-

What is the Buy to Let Stress Test and Will I Pass It?

Understanding the Buy to Let Stress Test If you’re considering investing in a buy-to-let property, understanding the intricacies of mortgage applications is advised. One key aspect that often confuses potential landlords is the Buy to Let (BTL) stress test. This test is a significant part of the mortgage approval process, and passing it is essential Read more

-

Equity Release For Purchases

Using Equity Release to Buy a Property If you’re over 55 and considering moving home, you might be wondering how to bridge the gap between what you sell your current property for and the cost of your new one. For many people in later life, income may no longer be sufficient to qualify for a Read more

-

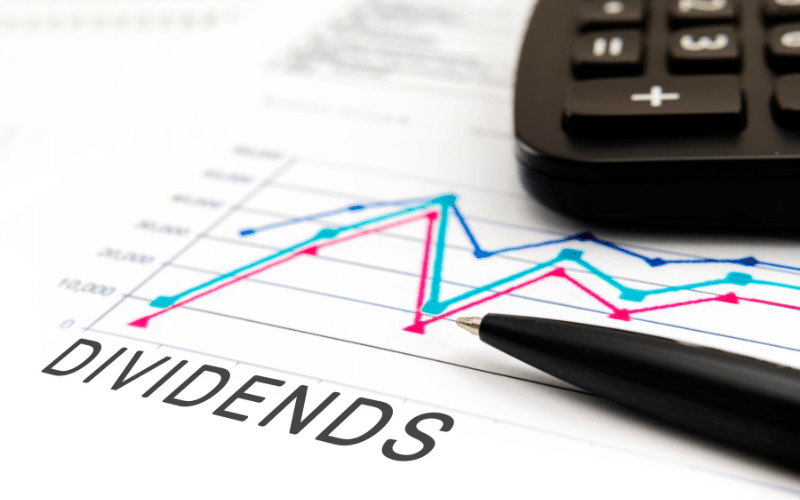

Can you get a mortgage using dividends

Mortgage Advice for Directors Using Dividends If you run your own limited company, you might choose to pay yourself a mix of salary and dividends for tax efficiency. While this approach can be great for reducing your tax bill, you may wonder how it affects your mortgage prospects. The good news is that many mortgage Read more

-

Bridging Loans for Companies

Bridging Loans for Companies: Secure Short-Term Finance for Business Growth When your company needs swift access to capital for property purchases, renovations, or business expansion, bridging loans can sometimes provide the solution. These short-term loans can help companies seize opportunities quickly, aiming for faster approvals than traditional commercial term finance. At Kerr & Watson, we Read more

-

Capital Raising on Mortgage Free Property

Capital Raising on Mortgage-Free Property | Your Expert Guide Owning a mortgage-free property is a significant milestone, representing financial security and stability. However, situations may arise where you need to raise capital, whether for home improvements, debt consolidation, or even property investment. In these instances, your property can be a valuable financial resource. What Does Read more

-

Commercial Finance For Football Clubs

How Commercial Finance Helps Football Clubs Grow On And Off The Pitch Running a football club is about far more than what happens over ninety minutes. You are managing a complex business that has to juggle player wages, transfer activity, stadium costs, community commitments and the expectations of supporters who want success every season. Commercial Read more

Adverse Credit Affordability BOE Bridging Loan Bridging Loan Cost Broker Firm of the Year (up to 10 advisers) Buy To Let Commercial mortgage Deposit Equity Release Expat Family Gifted Deposits Farnborough Farnham first time buyer Fixed Rate Foreign National Further Advance High Net Worth HMO Home Improvements Home Mover House Prices HSBC Inflation Inheritance tax Interest only Interest Rates Joint Borrower Sole Proprietor Large Mortgage Life Insurance Limited Company Buy to Let Mortgage Application Mortgage Introducer ONS Overdraft Pre-existing Condition Product Transfer Remortgage Self-Employed Shared Ownership Skipton Building Society Stamp Duty Transfer of Equity UAE

Why Kerr & Watson?

Understanding

We take the time to understand your situation so that we can search for the perfect mortgage and insurance for you. Any recommendation made is completely bespoke to your circumstances.

Experience

Mortgage and insurance advice is our speciality. We have decades of combined experience giving us the knowledge to overcome challenges and find the perfect solution for your needs.

Communication

We work around your schedule to arrange a mortgage or insurance policy that suits your needs. You’ll be kept updated throughout the entire process with clear communication so you’ll always know what’s going on.

Testimonials

Contact Us

Get A Free Consultation – Find out your options by speaking to a mortgage or insurance broker today.

By clicking on ‘Submit’, you consent to your contact details being stored by us and agree with our Privacy Policy.

Kerr & Watson | Address: Pembroke House, 8 St Christophers Pl, Farnborough GU14 0NH, UK | Phone: 01252 224620 | Email: info@kerrandwatson.co.uk | Hours: Mon-Fri 9:00–17:30