Key Points at a Glance:

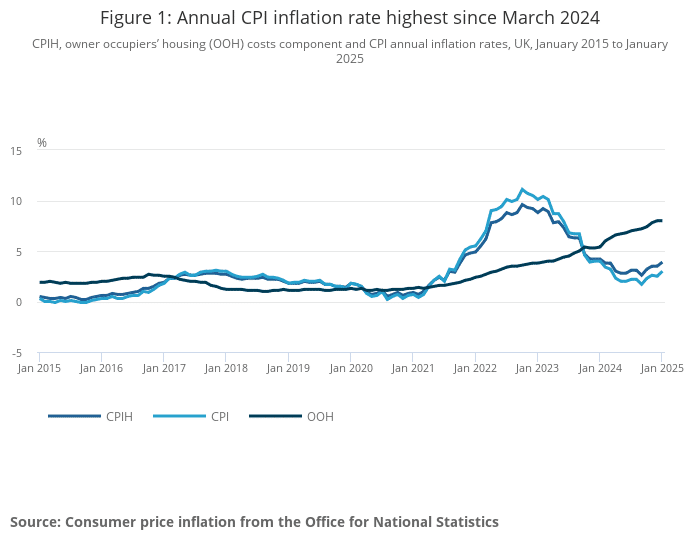

- The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.9% in the 12 months to January 2025, up from 3.5% in December 2024.

- The Consumer Prices Index (CPI) increased by 3.0% over the same period, rising from 2.5% in December.

- Key drivers of this increase include rising transport and food prices, while housing and household services had a downward impact.

- Core inflation, which excludes volatile items like energy and food, also rose, indicating underlying inflationary pressures.

- The Bank of England is expected to closely monitor these figures when considering future interest rate changes.

What’s Driving Inflation?

The increase in inflation this month has been largely influenced by specific sectors:

- Transport: The biggest driver of inflation this month, transport costs rose by 1.7% in the year to January, reversing a fall of 0.6% in December. Higher air fares and rising motor fuel prices contributed significantly to this increase.

- Food and Non-Alcoholic Beverages: Food inflation accelerated to 3.3% in January, up from 2.0% in December. This was due to price increases in meat, bread, cereals, and dairy products.

- Education: Private school fees saw a significant rise, partly due to changes in VAT regulations, leading to a jump in education costs.

At the same time, some areas helped offset inflation:

- Housing and Household Services: Inflation in this category eased slightly to 5.6% in January from 6.0% in December, mainly due to smaller increases in gas and electricity prices.

- Furniture and Household Goods: This category saw only a modest increase of 0.5%, following a slight decline in previous months.

How Does This Compare to Recent Trends?

Inflation remains well below the peak of 11.1% recorded in October 2022 but has edged up slightly compared to the latter half of 2024. After declining steadily for most of last year, this latest uptick suggests that inflationary pressures have not entirely disappeared.

Core inflation, which excludes energy, food, alcohol, and tobacco, also rose. Core CPIH climbed to 4.6% in January, up from 4.2% in December, while Core CPI increased from 3.2% to 3.7%. This suggests that underlying cost pressures remain strong, particularly in the services sector.

What Does This Mean for Interest Rates?

The Bank of England has maintained its base rate at 5.25% since August 2023, and economists have been watching for signs that rate cuts could be on the horizon. However, the latest inflation figures complicate this picture.

While the Bank is keen to bring inflation sustainably back to its 2% target, the recent uptick suggests that an immediate rate cut may not be likely. Higher core inflation and strong wage growth could mean that the Bank holds rates steady for longer to avoid reigniting price pressures.

There has been speculation that a rate cut could come later in 2025, but policymakers are likely to wait for clearer evidence of a sustained decline in inflation before making any moves.

Impact on Mortgages and Borrowers

For those with mortgages or looking to buy a home, the latest inflation news could have mixed implications:

- Fixed-Rate Mortgages: If the Bank of England keeps interest rates high for longer, lenders may be less likely to lower fixed mortgage rates in the short term. However, mortgage rates have already come down from their peaks, and lenders remain competitive.

- Tracker and Variable-Rate Mortgages: Those on variable-rate mortgages will be watching closely to see if rate cuts are delayed. A longer period of high rates could mean higher monthly repayments for longer.

- First-Time Buyers: With inflation still above target, affordability remains a challenge. However, a cooling in house price growth and increased lender competition may provide some opportunities.

Looking Ahead

The trajectory of inflation in the coming months will be key in shaping economic policy. Some factors to watch include:

- Wage Growth: Wages are still rising faster than inflation, which could keep demand strong and make it harder to bring inflation down.

- Energy Prices: Although gas and electricity prices have stabilised, any global supply disruptions could cause renewed price increases.

- Bank of England Decisions: Future inflation figures will heavily influence whether the Bank decides to cut interest rates later this year.

While inflation remains above the target, the overall trend suggests that we are moving towards a more stable economic environment. However, the journey to fully controlling inflation is not yet complete.

How Kerr & Watson Can Help

At Kerr & Watson, we understand that inflation and interest rate changes can impact your mortgage and financial planning. Whether you’re looking to remortgage, buy your first home, or explore protection options, our expert team is here to help.

- Mortgage Advice: We can help you find the best mortgage deals in the current climate, ensuring you secure the most competitive rates.

- Remortgaging Support: If your fixed-rate deal is ending, we can guide you through your options to avoid unnecessary increases in repayments.

- Protection Planning: With economic uncertainty, ensuring you have the right insurance and protection in place is more important than ever.

Contact Us for Tailored Mortgage and Insurance Advice

Understanding inflation and its impact on interest rates is key to making informed financial decisions. Our team at Kerr & Watson is here to provide expert guidance tailored to your circumstances.

Contact us today to explore how these economic changes could affect your mortgage and financial planning

Data Source: Office for National Statistics (ONS) Read more: Consumer price inflation, UK: January 2025