Key Points at a Glance:

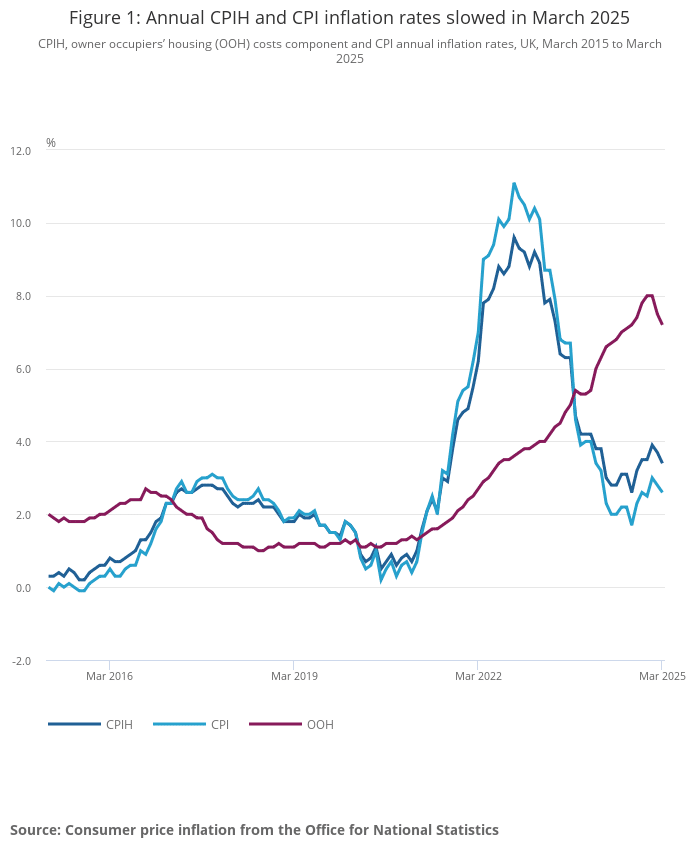

- The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.4% in the 12 months to March 2025, down from 3.7% in February.

- The Consumer Prices Index (CPI) fell to 2.6%, down from 2.8% the previous month.

- The largest contributors to this slowdown came from lower costs in recreation and culture, motor fuels, and housing services.

- Clothing and footwear prices increased, offering a small upward push to overall inflation.

- Core inflation remains elevated, with CPIH excluding food, energy, alcohol and tobacco at 4.2%.

What’s Behind the Numbers?

Inflation has eased slightly in March, continuing the gradual downward trend seen in recent months. This time last year, monthly price increases were higher, so the current 0.3% monthly rise in CPI and CPIH is a clear signal that pressures are softening.

A key contributor to this slowdown is the cost of recreation and culture, which saw the lowest rate of price increases since October 2021. Motor fuels also saw notable price drops, especially for petrol and diesel, helping to pull the overall transport category lower. There were also signs of easing in housing and household services, including a slower rise in owner occupiers’ housing costs.

However, not everything moved in the same direction. Clothing and footwear, which often see seasonal price changes, posted higher-than-usual price rises as spring collections landed in shops.

Core Inflation Remains Stubborn

Core inflation – which strips out the more volatile items like food, energy, alcohol and tobacco – dropped slightly but is still sitting at 4.2% for CPIH and 3.4% for CPI. This figure matters because it shows what’s happening to broader prices across services and goods that tend to be more stable over time.

So, while headline inflation has eased, the stickier components of the economy are still running hot. This gives the Bank of England a reason to stay cautious when it comes to changing interest rates.

Owner Occupiers’ Housing Costs Still Elevated

The housing and household services category continues to be one of the main drivers of inflation. In particular, the owner occupiers’ housing (OOH) costs element rose by 7.2% over the past year, though this is slightly down from 7.5% in February.

This reflects continued upward pressure on housing-related costs like mortgage interest payments, repairs, and maintenance. It’s a reminder that while general inflation is easing, homeowners may still be feeling the pinch from rising housing expenses.

Energy and Food Costs Stabilise

Energy and food prices have played a major role in past inflation spikes. Fortunately, these areas showed signs of flattening out in March. Food and non-alcoholic beverages rose by 3.0% in the year to March, down from 3.3% the month before. Monthly food prices didn’t rise at all in March, which is welcome news for households managing tight budgets.

Meanwhile, the cost of electricity, gas and other fuels has become less volatile. This helped take pressure off both CPIH and CPI readings, as energy prices were previously a big driver of high inflation.

Clothing Prices Bounce Back

An unexpected upward contribution came from clothing and footwear. Prices rose by 1.1% in the 12 months to March 2025, compared to a drop of 0.6% the month before. On a monthly basis, this category saw a significant 2.3% increase, reflecting a sharp turnaround likely driven by fewer discount sales and the introduction of new seasonal ranges.

This shows that while some sectors are cooling, others are still seeing inflation due to retail trends and consumer demand.

What Does This Mean for Interest Rates?

With CPI now at 2.6%, interest rates are under fresh scrutiny. The Bank of England will be weighing up whether there’s enough evidence of inflation cooling off across the board before making a move.

The current base rate remains at 5.25%, and there’s growing speculation that a rate cut could be on the table later this year. However, the Bank is likely to take a cautious approach, particularly with wage growth and core inflation still running high.

The Political and Economic Context

This inflation data lands at a time when households are still adjusting to previous cost-of-living increases. Despite the downward trend in headline inflation, prices remain significantly higher than they were two or three years ago.

As inflation eases, there’s increasing pressure on policymakers to consider how to support economic growth without fuelling a rebound in inflation. Political leaders will likely use these figures to reinforce their respective economic strategies in the lead-up to future fiscal decisions.

Looking Ahead

While it’s encouraging to see inflation easing again in March, the outlook is still mixed. Here are a few points to keep in mind:

- Core inflation and services inflation remain high, meaning price pressures haven’t disappeared completely.

- Housing costs continue to rise, especially for homeowners, which can affect affordability for new buyers and those remortgaging.

- Seasonal trends, such as spring clothing ranges, can create temporary fluctuations in inflation.

- Any changes in interest rates will depend on whether inflation continues to ease in the coming months.

What This Means for You

If you’re thinking about buying a home, remortgaging, or reviewing your protection cover, this period of relative inflation stability could provide opportunities. Mortgage lenders watch inflation and interest rate trends closely, which means the current environment could influence your borrowing options.

Whether interest rates drop later this year or stay higher for longer, it’s important to get expert advice to understand what’s right for your situation. Changes in inflation can affect not just your mortgage rate, but your insurance premiums and your broader financial plans too.

How Kerr & Watson Can Support You

At Kerr & Watson, we keep a close eye on economic developments so we can offer the best advice tailored to your needs. If you’re wondering how the latest inflation data might affect your mortgage, your borrowing capacity, or your protection arrangements, we’re here to help.

Whether you’re a first-time buyer, a homeowner considering a remortgage, or simply want peace of mind about your current cover, our advice is personal and easy to understand.

Let’s Talk

No two financial journeys are the same. That’s why we take the time to get to know you and your goals. With up-to-date insights and expert guidance, Kerr & Watson can help you navigate this evolving economic landscape with confidence.

Get in touch today to see how we can support your next steps.

Data Source: Office for National Statistics (ONS) Read more: Consumer price inflation, UK: March 2025