Inflation holds steady at 2% in year to June

Key Points at a Glance:

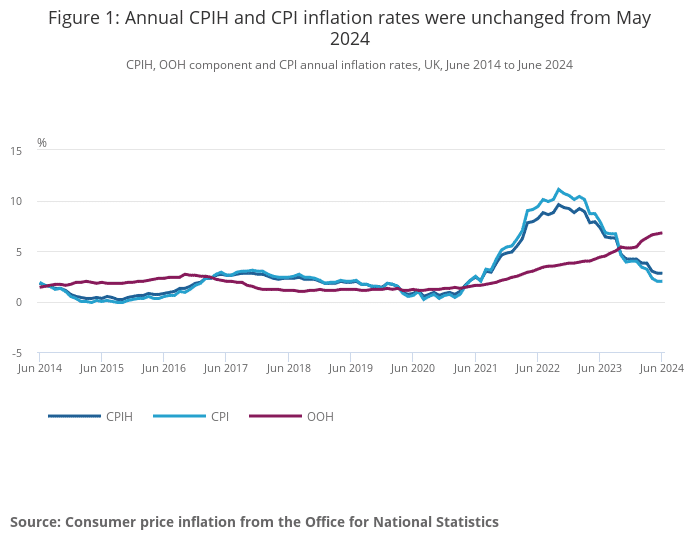

- The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 2.8% in the 12 months to May 2024, down from 3.0% in the 12 months to April.

- The Consumer Prices Index (CPI) rose by 2.0% in the 12 months to June 2024, the same rate as the 12 months to May 2024.

In June 2024, both the CPIH and CPI inflation rates held steady compared to May 2024. This stability is notable, considering the economic fluctuations of recent years.

For the second consecutive month, inflation met the Bank of England’s 2% target, increasing the likelihood of a potential rate cut in August from last week’s 50%. However, services inflation, a key metric for the Monetary Policy Committee, remained persistently high at 5.7%.

Key Drivers of Inflation

The consistent inflation rate in June 2024 was influenced by several factors:

Restaurants and Hotels:

Prices in this sector rose significantly, contributing positively to the inflation rate. The increase was largely due to higher hotel prices, which saw a monthly rise of 8.8% compared to a lower increase of 1.7% the previous year.

Clothing and Footwear:

There was a notable downward contribution from this sector. Prices fell by 1.2% monthly, reflecting larger sale discounts than a year ago.

Transport:

Although overall transport costs increased by 0.7% annually, this was tempered by a decrease in fuel prices and second-hand car prices, which continued to decline.

Food and Non-Alcoholic Beverages:

The annual rate of increase for food and non-alcoholic beverages slowed to 1.5%, down from 1.7% in May 2024. This easing has been consistent for several months, showing a significant drop from a peak of 19.2% in March 2023.

A Look at Recent Fluctuations and Economic Impact

Inflation rates have fluctuated significantly over recent years, peaking at 11.1% in October 2022, the highest in over 40 years. This spike was driven by the post-pandemic surge in demand and geopolitical tensions impacting energy prices. Since then, inflation has been on a downward trend, providing some relief to consumers and businesses.

Find out Your Options

Implications for Interest Rates

The Bank of England closely monitors these inflation figures to guide its interest rate decisions. With the current inflation rate stable at the target of 2%, there is speculation about the potential for a rate cut. However, the Bank is likely to proceed cautiously, waiting for further evidence of sustained control over inflation.

Future Outlook

While the current inflation rates are promising, there are several factors that could influence future economic stability:

Core Inflation

The core CPIH remains high at 4.2%, indicating underlying inflationary pressures excluding volatile items like energy and food.

Wage Growth

High wage growth, at an annual rate of 6%, continues to be a concern as it could drive further demand and potentially reignite inflation.

Political Reactions

Labour may continue to focus on the cost of living crisis, emphasizing that food prices remain significantly higher than in previous years, despite the easing inflation rates.

Conclusion

The stability in inflation rates is a positive sign, indicating that the measures taken by the Bank of England and other economic policies are having the desired effect. However, the broader economic landscape remains complex, with several factors needing careful consideration. As policymakers prepare for the next meeting, they will balance the need for economic stability with ongoing challenges such as wage growth and core inflation.

Moving Forward: How We Can Help

At Kerr & Watson, we understand that these economic changes can impact your financial plans. Whether you need to reassess your mortgage options or review your insurance and protection plans, our team is here to provide expert advice tailored to your unique situation.

Contact Us for Bespoke Mortgage and Insurance Advice

Every financial journey is unique, and we are committed to guiding you through yours with expert advice and personalised solutions. Contact us to discuss how the latest economic changes can influence your mortgage and protection strategies.

Data Source: Office for National Statistics (ONS)

Read more: Consumer price inflation, UK: June 2024