Inflation rises to 2.3% in October after energy bills rise

Key Points at a Glance:

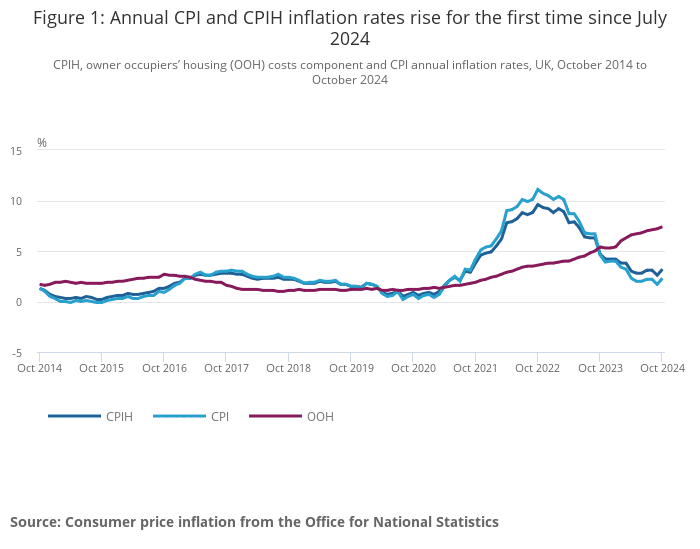

- The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.2% in the 12 months to October, up from 2.6% in September.

- CPI increased by 2.3% in the 12 months to October, up from 1.7% in September.

- The primary drivers of this increase were rising energy costs, with housing and household services making the biggest contribution.

Inflation Trends and Contributing Factors

Inflation picked up pace in October, as shown by the latest figures from the Consumer Prices Index (CPI) and CPIH. Here’s a breakdown of what’s driving these changes:

Housing and Household Services

One of the largest factors behind the increase in inflation is the significant rise in energy prices.

- Electricity: Prices increased by 7.7% in October 2024, compared to a drop of 7.5% in the same period last year.

- Gas: Likewise, gas prices jumped by 11.7%, reversing a 7.0% fall from the previous year.

The October rise reflects changes in the energy price cap set by Ofgem. These energy price hikes have had a broad impact, making housing and household-related costs the main contributors to higher inflation.

Recreation and Culture

On the flip side, the recreation and culture sector offered some downward pressure. Price drops in cultural services and data processing equipment helped to moderate the overall inflation figures.

Monthly Changes

On a monthly basis, CPI and CPIH both increased by 0.6% in October. This was a sharper rise than the little-to-no change seen in October 2023. The shift in inflation rates between September and October indicates renewed upward pressure in certain sectors, particularly:

- Energy Costs: These rose substantially, reversing prior declines and placing new financial pressures on households.

- Housing Services: Owner occupiers’ housing costs (OOH) increased, reaching 7.4%, the highest annual rate since early 1992.

Core Inflation

Core inflation, which excludes more volatile elements such as energy, food, alcohol, and tobacco, also saw a rise:

- Core CPIH: Increased slightly to 4.1% from 4.0% in September.

- Core CPI: Edged up to 3.3% from 3.2% the previous month.

Despite overall inflation being lower than historical peaks, core inflation remains stubbornly high, highlighting underlying economic pressures.

Historical Context

Inflation peaked at over 11% in October 2022, marking a 40-year high due to soaring energy prices and global supply chain disruptions. Since then, inflation has generally trended downward, but October’s figures show that it’s still not smooth sailing. Energy costs, although moderated from their 2022 highs, remain elevated and continue to influence the overall inflation rate.

Sector-Specific Insights

Transport

While the transport sector saw a 2.0% decline in prices compared to the previous year, there were some notable monthly increases:

- Second-Hand Cars: Prices rose by 0.2% in October, compared to a more significant decline a year ago.

- Airfares: Jumped by 6.3% in October, the largest monthly increase in years, driven by European travel demand.

Food and Non-Alcoholic Beverages

Food prices showed only a modest annual increase of 1.9% in October, a far cry from the peak of 19.2% in March 2023. The categories contributing to inflation included vegetables and some beverages, although many other food items saw price stability or reductions.

Looking Ahead

The latest figures paint a mixed picture. While headline inflation has moderated from past highs, the uptick in October raises questions about the sustainability of economic improvements. Key issues to watch include:

- Energy Market Trends: Any further changes in energy costs could have immediate effects on inflation.

- Consumer Behaviour: How households adapt to continued price pressures may influence overall economic growth.

Conclusion

Inflation remains a key economic issue, and the October data underlines the challenges ahead. With energy prices still volatile and core inflation proving hard to tame, the economic outlook remains uncertain. However, understanding these trends can help in making informed financial decisions.

Data Source: Office for National Statistics (ONS) Read more: Consumer price inflation, UK: October2024