Inflation – November 2025 At a glance

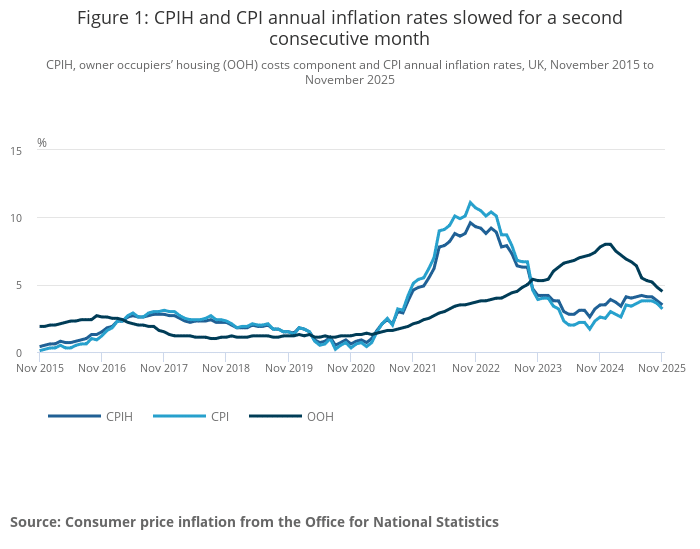

Inflation cooled again in November 2025, and that matters because it affects the cost of everyday life and, indirectly, the direction of interest rates. The main measure most people follow is the Consumer Prices Index (CPI). In simple terms, CPI tracks how much prices are rising (or falling) across a broad “basket” of things you spend money on, like food, transport, clothing, and services.

For November 2025, CPI came in at 3.2% over the last 12 months. That’s down from 3.6% in October. Prices also fell on the month, with CPI down by 0.2% in November, compared with a small rise of 0.1% in the same month last year. In plain English: prices didn’t just rise more slowly; on average, they dipped slightly compared with the previous month.

Key points at a glance

Here are the headline numbers and what’s most important:

- CPI inflation was 3.2% in the 12 months to November 2025, down from 3.6% in October.

- CPI fell by 0.2% in November 2025 on a monthly basis (October to November), whereas it rose by 0.1% in November 2024.

- The biggest downward pushes on inflation came from:

- food and non-alcoholic drinks

- alcohol and tobacco

- “Core” CPI (which strips out energy, food, alcohol and tobacco) eased to 3.2%, down from 3.4%.

- Goods inflation slowed to 2.1% (down from 2.6%), while services inflation eased slightly to 4.4% (down from 4.5%).

Why the CPI rate fell in November

Inflation usually doesn’t move because one single thing changes. It shifts because some prices rise, some fall, and the balance between them changes from month to month.

In November, the overall CPI rate eased because more categories pushed inflation down than pushed it up. Two areas did most of the heavy lifting: food and drink, and alcohol and tobacco. Clothing also moved into negative annual inflation (meaning prices are lower than a year ago), which helped too.

At the same time, there were still areas where prices were rising and continuing to put pressure on household budgets. Housing and household services remained one of the bigger sources of upward pressure, even though the annual rate there eased slightly.

What’s happening in the areas you feel day to day

Food and non-alcoholic beverages

Food is one of those costs you can’t easily avoid, so even small changes matter. The good news this month is that food inflation slowed.

- Food and non-alcoholic drinks rose by 4.2% over the year to November, down from 4.9% in October.

- Prices fell by 0.2% on the month (October to November), compared with a rise of 0.5% in the same period last year.

What that can mean for you: if you’ve felt like the weekly shop has been relentlessly climbing, this suggests some of that pressure is starting to ease. It doesn’t mean prices are “back to normal”, but it can be a sign that the pace of increases is cooling.

Alcohol and tobacco

This category also pulled inflation down in November.

- Alcohol and tobacco rose by 4.0% over the year, down from 5.9% in October.

- Prices fell by 0.4% on the month, compared with a rise of 1.4% a year ago.

What that can mean for you: this is another small sign of easing price pressure. It won’t change everyone’s budget, but it adds to the overall picture of inflation coming off the boil.

Clothing and footwear

Clothing moved into negative inflation on the year, which means prices were lower than they were 12 months ago.

- Clothing and footwear fell by 0.6% over the year (after a small rise of 0.3% in October).

- Prices fell by 0.3% on the month.

What that can mean for you: if you’ve been waiting to replace winter essentials or kids’ clothing, discounting (often around seasonal promotions) can pull this category down quickly, and you may notice better deals than earlier in the year.

Housing and household services

Even though this update focuses on CPI, housing-related costs still matter because they feed into the broader cost of living and can influence how confident policymakers feel about inflation being under control.

- Housing and household services rose by 5.1% over the year, slightly down from 5.2% in October.

- Prices rose by 0.2% on the month.

What that can mean for you: housing costs are still rising faster than the overall inflation rate. If your budget is tight, this is one of the reasons it may not feel like inflation is “fixed”, even when the headline CPI number comes down.

Transport

Transport continued to show a negative monthly movement.

- Transport rose by 3.7% over the year (down slightly from 3.8% in October).

- Prices fell by 0.8% on the month.

What that can mean for you: you may see some relief in certain transport costs month to month, even if annual prices are still higher than before.

Services versus goods: why this matters for interest rates

One of the key things decision-makers watch is the difference between goods inflation and services inflation.

- Goods inflation slowed to 2.1% (from 2.6%).

- Services inflation eased to 4.4% (from 4.5%).

Services inflation is still the stickier part of the picture. Services include things like hospitality, leisure, personal services, and other labour-heavy costs. Wages and staffing costs can make services slower to come down, even when goods prices cool.

What that can mean for you: when services inflation stays higher, it can make policymakers more cautious about cutting interest rates quickly. Even if food or goods prices improve, persistent services inflation can keep the conversation focused on “wait and see”.

Core inflation: the underlying temperature check

Core CPI removes energy, food, alcohol and tobacco. It’s not because those things don’t matter (they absolutely do), but because they can jump around from month to month. Core CPI helps show whether inflation is easing in a broader, more sustained way.

- Core CPI was 3.2% in November, down from 3.4% in October.

- Core CPI also fell by 0.2% on the month.

What that can mean for you: this is one of the clearer signs that inflation pressure isn’t just falling because of one-off price drops. It suggests a slightly wider softening in the pace of price growth.

What this could mean for your mortgage and your next steps

Inflation is only one piece of the puzzle, but it influences interest rates, and interest rates influence mortgage pricing and affordability.

Here’s how you can think about it in practical terms:

- If you’re remortgaging soon, a lower CPI reading can help build the case for calmer rate expectations over time, but it doesn’t automatically mean deals will drop immediately.

- If you’re buying your first home or moving, stable or falling inflation can be reassuring, but your lender will still assess you based on your income, commitments, and how well you can handle repayments.

- If you’re on a variable rate, you’ll naturally be watching rate decisions closely. Inflation moving down is a step in the right direction, but services inflation is still elevated, which can slow the pace of any change.

A sensible approach is to plan around what you can control:

- Check when your current deal ends and what your options are if you secure a new rate early.

- Review your monthly spending and credit commitments, because affordability is assessed on the full picture, not just your salary.

- Think about your tolerance for change: do you want payment certainty, or are you comfortable with more movement?

At Kerr & Watson, you get clear advice that fits your situation, not a one-size-fits-all answer. Whether you’re due to remortgage, you’re weighing up fixed versus variable, or you’re trying to work out what you can borrow in today’s market, you can talk it through and leave with a plan that makes sense.

Upcoming Bank of England base rate decision

Tomorrow, the Bank of England announces whether it will keep the base rate at 4% or make a change. With CPI inflation easing to 3.2% in November, some commentators think that strengthens the case for a small cut, but it’s not a done deal because services inflation is still higher than goods and the Bank will want to see inflation continue to settle. For you, the key point is that mortgage pricing often starts adjusting before the announcement, so whether you’re remortgaging or buying, it’s worth looking at your options now (especially if your current deal ends soon) so you can choose between securing payment certainty on a fixed rate or keeping flexibility if rates continue to drift down.

Looking ahead

November’s inflation data shows a second month of easing in the headline CPI rate, with noticeable improvements coming from food and drink, alcohol and tobacco, and clothing. The bigger picture is moving in a better direction, but it’s still a mixed landscape, especially with services costs running higher than goods.

If you want to understand what this inflation update could mean for your mortgage options or protection planning, you can get in touch with Kerr & Watson and talk it through in plain language, with clear next steps.

Read more: Consumer price inflation, November 2025