UK inflation rate rises for second month in a row

Key Points at a Glance:

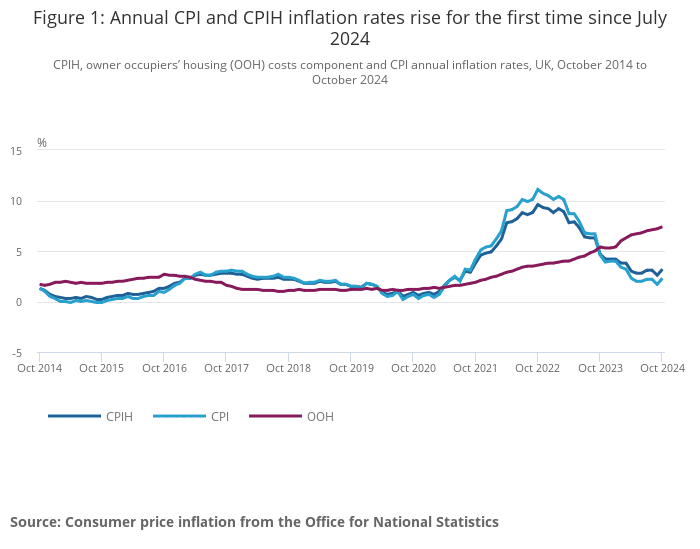

- The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.5% in the 12 months to November 2024, up from 3.2% in the 12 months to October.

- The Consumer Prices Index (CPI) rose by 2.6% in the 12 months to November 2024, up from 2.3% in the 12 months to October.

- The largest upward contribution to the monthly change in both CPIH and CPI annual rates came from transport, with a further large upward effect in CPIH from housing and household services.

For the second consecutive month, inflation has risen. The Consumer Prices Index including owner occupiers’ housing costs (CPIH) increased to 3.5% in the 12 months to November, and the Consumer Prices Index (CPI) rose to 2.6%. This comes after inflation’s steady decline throughout much of the year. Let’s explore what’s driving this change and what it means for you.

What’s Driving Inflation?

Inflation is influenced by numerous factors. In November, the most notable contributors were:

Transport Costs

- Prices in the transport sector fell by 1.1% annually but less sharply than the 2.0% decrease in October.

- Motor fuel prices saw a modest monthly rise, with petrol up by 0.8 pence per litre and diesel by 1.4 pence per litre compared to October.

- Second-hand car prices stabilised, falling by just 0.2% compared to a larger drop last year.

Housing and Household Services

- Housing costs rose significantly, with owner occupiers’ housing costs up by 7.8%, marking the highest annual rate since February 1992.

- Actual rental prices also contributed, climbing to an annual increase of 7.6%.

Recreation and Culture

- Prices in this sector rose by 3.6%, driven by increases in cultural services like live event tickets and computer games.

Alcohol and Tobacco

- Alcohol and tobacco prices surged by 6.8%, the largest annual increase seen this year, reflecting changing excise duties and market conditions.

Historical Context

While the current figures are modest compared to the peak inflation rates of 2022, they highlight the persistence of certain economic pressures:

- Inflation reached a staggering 11.1% in October 2022, driven by soaring energy costs and supply chain disruptions.

- The current rise signals that while the worst may be over, underlying pressures remain.

Implications for Interest Rates

The Bank of England’s current interest rate is 5.25%. Despite this rate’s role in slowing inflation earlier this year, the recent uptick may delay any potential reductions.

Key Considerations:

- Core Inflation: At 4.4%, core inflation remains well above comfortable levels, prompting continued caution.

- Wage Growth: With annual wage increases staying high, consumer demand could further fuel inflation.

Economists predict that rate cuts are unlikely until there is clear evidence of sustained inflation control, possibly into 2025.

Future Outlook

While the inflation increase in November raises concerns, it is essential to look at the broader picture. Factors to watch include:

- Energy Costs: Winter energy usage could drive up household bills, impacting CPIH.

- Global Events: Supply chain shifts and geopolitical factors continue to influence prices.

- Consumer Behaviour: Spending patterns in the holiday season may provide further insight into inflation trends.

What This Means for You

The current economic climate presents both challenges and opportunities. Rising inflation can affect various aspects of your financial planning, including mortgages and savings.

Mortgage Considerations:

Existing Homeowners

If you’re on a variable-rate mortgage, recent trends may keep your rates stable for now but watch for updates from lenders.

First-Time Buyers

Higher inflation could influence borrowing capacity, making expert advice crucial.

Moving Forward: How We Can Help

At Kerr & Watson, we understand the complexities of navigating financial decisions in a shifting economic landscape. Whether you’re considering a mortgage, reviewing your protection plans, or exploring options to safeguard your finances, our team is here to help.

Why Choose Us?

- Tailored Advice: We provide solutions designed around your unique circumstances.

- Up-to-Date Knowledge: We stay on top of market trends to ensure you receive accurate and timely guidance.

- Holistic Support: From initial consultations to ongoing reviews, we are with you every step of the way.

Contact us today to discuss how the latest inflation changes might affect your financial plans. Together, we can create strategies to navigate these evolving times confidently.

Data Source: Office for National Statistics (ONS) Read more: Consumer price inflation, UK: November 2024