UK inflation stays flat at 4% in January

Key Points at a Glance:

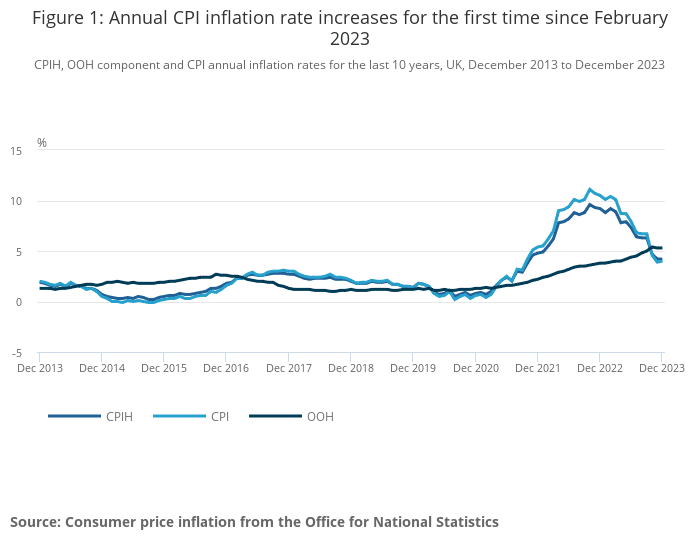

- CPI: Rose by 4.0% in the 12 months to January 2024, the same rate as in December 2023.

- CPIH: rose by 4.2% in the 12 months to January 2024, the same rate as in December 2023.

- Energy Prices: The largest upward contribution to the monthly change came from housing and household services (principally higher gas and electricity charges).

Stability in CPIH and CPI Rates

In January 2024, the Consumer Prices Index including owner occupiers’ housing costs (CPIH) remained stable at a 4.2% annual rate, consistent with December 2023 figures. Similarly, the Consumer Prices Index (CPI) maintained its annual growth rate at 4.0%.

Monthly changes also mirrored the previous year (December), with CPIH and CPI experiencing declines of 0.4% and 0.6%, respectively, demonstrating a pattern of stability in these metrics.

Key Drivers of Inflation

The inflation landscape was significantly influenced by sector-specific trends. Housing and household services, particularly due to increased gas and electricity charges (recent rise in the energy price cap), drove the largest upward contributions to both CPIH and CPI annual rates.

In contrast, furniture and household goods, alongside food and non-alcoholic beverages, exerted the most considerable downward pressures.

How will this affect Interest Rates?

These figures will be viewed positively by the Bank of England as economists prior anticipated that the inflation figures to reach 4.2%. Economists are already predicting that inflation will fall to 3.4pc in February.

A fall in interest rates, which currently stand at 5.25pc, would ease restrictions on household spending, delivering a boost for the economy.

Find out Your Options

Government’s Stance on Inflation Trends

In light of the latest inflation data, Chancellor Jeremy Hunt acknowledged “Inflation never falls in a perfect straight line, but the plan is working; we have made huge progress in bringing inflation down from 11%, and the Bank of England forecast that it will fall to around 2% in a matter of months.”

Moving Forward: How We Can Help

As your dedicated advisors at Kerr & Watson, we’re here to help you navigate these changes. Whether it’s reassessing your mortgage options in light of the current economic climate or reviewing your insurance and protection plans, our team is equipped to provide tailored advice.

Contact Us for Bespoke Advice

Every financial journey is unique, and we’re committed to guiding you through yours with expert advice and personalised solutions.

Contact us to discuss how the latest economic changes can influence your mortgage and protection strategies.

Data Source: Office for National Statistics (ONS)

Read more: Consumer price inflation, UK: February 2024