Key Points at a Glance:

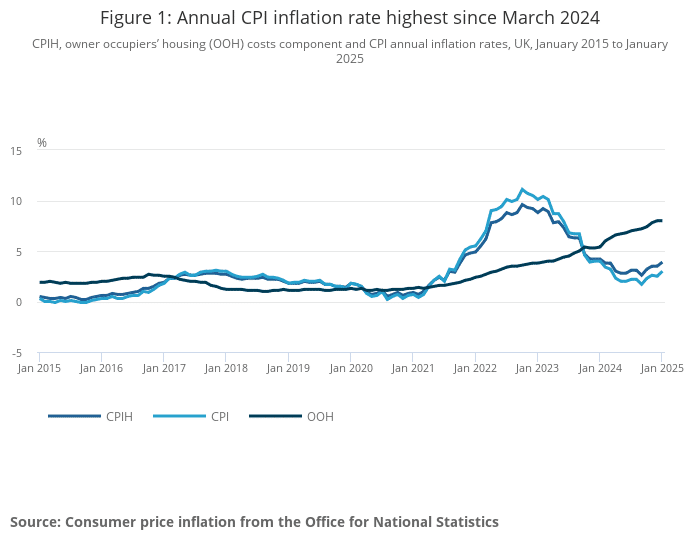

- The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.7% in the 12 months to February 2025, down from 3.9% in January.

- The Consumer Prices Index (CPI) fell to 2.8% in February, down from 3.0% the previous month.

- The easing was largely driven by falling clothing prices and a slight reduction in housing and household services costs.

- Core inflation remains elevated, with services and wage pressures still influencing the outlook.

What’s Happening With Inflation?

Inflation has eased slightly again this month. The Consumer Prices Index (CPI), which tracks the average change in prices paid by households for goods and services, has dropped to 2.8% in the 12 months to February 2025. This is down from 3.0% in January and shows a continuing downward trend, albeit gradual.

The broader measure, CPIH – which also includes housing costs for homeowners – stands at 3.7%, slightly down from 3.9% in January.

While it’s not a huge drop, it’s still a move in the right direction.

Key Drivers Behind the Change

The drop in inflation this month has been influenced by a few main areas:

- Clothing and Footwear: Prices in this category actually fell by 0.6% over the past 12 months. That’s the first negative annual rate since late 2021, mostly due to more discounting in early 2025.

- Housing and Household Services: While still elevated at 5.3%, this category saw a modest slowdown. Owner occupiers’ housing costs, which had been steadily rising, increased by 7.5% – down from 8.0% the previous month.

- Recreation and Culture: This sector also contributed to the drop, with some reductions seen in the prices of things like live events and entertainment media.

At the same time, a few areas saw price rises that slightly offset the overall downward trend:

- Alcohol and Tobacco: Prices jumped following a rise in duty from 1 February 2025, with alcohol and tobacco inflation up to 5.7%.

- Communication Services: Mobile app prices increased, contributing to a higher inflation rate in this sector (7.3%).

The Bigger Picture

Inflation remains above the Bank of England’s target of 2%, and while the pace of price increases is slowing, the path to full stability isn’t quite clear yet.

Core inflation – which strips out volatile items like energy and food – is still relatively high:

- Core CPI: 3.5%

- Core CPIH: 4.4%

These figures suggest that underlying inflationary pressures, especially in services, remain sticky. Services inflation, for example, is still running at 5.0%, with catering and accommodation playing a role.

Why Does This Matter?

If you’re thinking about your mortgage, household budgeting or long-term financial planning, inflation plays a big role.

Higher inflation tends to lead to higher interest rates, as the Bank of England uses rates to try and bring inflation down. At the moment, the base rate sits at 4.50%. While there’s some expectation that a cut could happen later this year, it’s not guaranteed.

The Bank is likely to want more consistent evidence of inflation easing – especially core and wage inflation – before making any moves.

In the meantime, higher borrowing costs are still in place. That affects everything from mortgage repayments to credit cards and loans.

What About Households and Housing?

Housing-related inflation remains one of the biggest contributors to the CPIH rate, particularly due to:

- Owner Occupiers’ Housing Costs (OOH): Up 7.5% annually, though this is a drop from January’s 8.0%.

- Private Rents: Still climbing, but at a slower pace – up 7.4% this month.

Energy bills, council tax and maintenance all feed into this broader category, which remains a key pressure point for households.

Looking Ahead

While the downward movement in inflation is welcome, a few concerns remain:

- Wage Growth: Still high, which can feed inflation if it leads to increased consumer demand.

- Sticky Core Inflation: Even with headline figures falling, core inflation is stubborn.

- Political Landscape: Economic policy is under close scrutiny ahead of the election campaign, and that may influence the pace or nature of any policy changes.

What Does This Mean for You?

For homeowners or anyone considering a mortgage, the current environment means:

- Interest rates are still high, and while a cut might happen later this year, there’s no certainty.

- If you’re on a variable rate or tracker mortgage, your repayments are still feeling the impact of previous rate hikes.

- If you’re coming to the end of a fixed rate, it’s worth reviewing your options early – there may be opportunities to lock in more favourable terms depending on how things shift.

- For first-time buyers, affordability remains a key challenge, but if inflation continues to ease, this could open up better deals over time.

How Kerr & Watson Can Help

At Kerr & Watson, we’re here to help you make sense of the numbers and how they affect you.

Whether you’re remortgaging, moving home, or just want to make sure your protection plans are still right for your circumstances, we offer clear, no-nonsense advice.

We know that every situation is different. That’s why we take the time to understand your needs and give personalised guidance that suits your goals.

Get in Touch

If you’re wondering how the latest inflation figures could affect your mortgage or protection plans, speak to us today.

Let’s take a look at your current setup and see how we can help you plan confidently for the months ahead.

Contact us today to explore how these economic changes could affect your mortgage and financial planning

Data Source: Office for National Statistics (ONS) Read more: Consumer price inflation, UK: February 2025