Key Points at a Glance

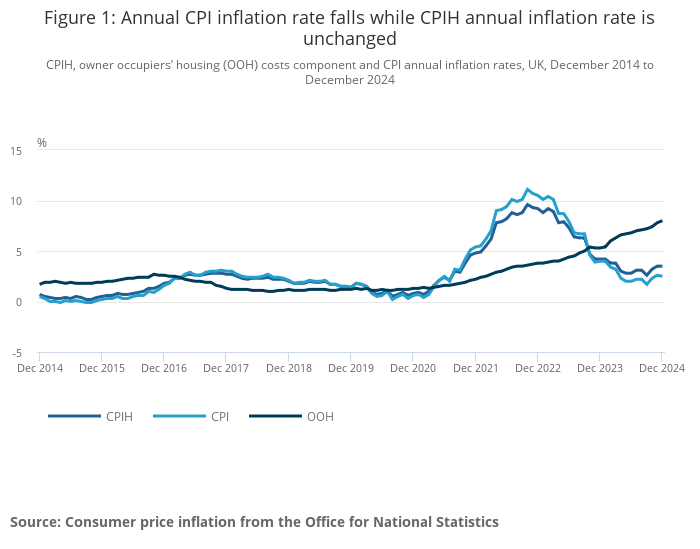

- CPIH Annual Rate: The Consumer Prices Index including owner occupiers’ housing costs (CPIH) remained steady at 3.5% in December, unchanged from November.

- CPI Annual Rate: The Consumer Prices Index (CPI) dropped slightly to 2.5%, down from 2.6% in November.

- Core CPIH: Excluding volatile items like energy and food, core CPIH decreased to 4.2%, down from 4.4% in November.

- Biggest Influences: Transport costs pushed inflation upwards, while restaurants and hotels contributed to the decrease.

Key Drivers of December 2024 Inflation

Transport

Transport costs were a significant upward driver, with price increases in motor fuels and second-hand cars.

- Motor Fuels: Petrol prices rose by 1.4p per litre, while diesel prices increased by 2.0p per litre compared to November.

- Second-hand Cars: Prices saw a modest annual increase of 1.0%, rebounding after months of decline.

Restaurants and Hotels

This sector was the largest contributor to the downward trend.

- Annual Rate: Inflation for restaurants and hotels dropped to 3.4%, the lowest since mid-2021.

- Monthly Decline: Prices fell slightly by 0.1%, reflecting reduced seasonal demand and stabilised costs.

Housing and Household Services

Costs in this area rose, driven primarily by owner-occupiers’ housing costs (OOH).

- OOH Annual Rate: Increased to 8.0%, the highest since February 1992.

- Overall Housing Costs: Annual inflation for housing and household services reached 6.0%, up from 5.8% in November.

Food and Non-Alcoholic Beverages

Food prices stabilised after a period of rapid increases.

- Annual Rate: Growth remained at 2.0%, a far cry from the highs of early 2023.

- Notable Changes: Bread, cereals, and soft drinks experienced slower price rises, while sugar and fruit saw marginal increases.

Historical Context

Inflation has been on a downward trend since peaking at 11.1% in October 2022. This steep rise was largely driven by global energy crises and supply chain disruptions. The return to more moderate levels offers some relief but also highlights the persistent challenges in specific areas such as housing and core services.

What This Means for Interest Rates

The Bank of England closely monitors inflation when setting interest rates. With the CPI now well below its 2022 peak, there may be room for cautious adjustments.

- Current Base Rate: Interest rates remain at 5.25%, a level intended to temper inflationary pressures.

- Outlook: While some experts predict a possible rate cut in 2025, the Bank is likely to hold rates steady until there is clearer evidence of sustained stability.

High inflation in services and wage growth continue to pose challenges, which could influence future policy decisions.

Implications for You

Inflation impacts nearly every aspect of personal finances, from day-to-day expenses to long-term planning.

Here’s how these trends could affect you:

Mortgages

- Existing Homeowners: If you’re on a variable or tracker mortgage, high interest rates might mean continued elevated repayments.

- First-time Buyers: Stabilising inflation could eventually lead to rate reductions, improving affordability.

Living Costs

- Transport and Energy: Rising costs in transport may strain monthly budgets. Plan for seasonal fluctuations in energy prices.

- Discretionary Spending: Sectors like restaurants and hotels are seeing slower price increases, which may offer some respite.

Planning Ahead

With inflation remaining relatively high in housing and core services, budgeting carefully and seeking financial advice are more important than ever.

Moving Forward: How Kerr & Watson Can Help

At Kerr & Watson, we specialise in helping you navigate financial challenges with expert advice tailored to your unique situation.

Whether you’re considering remortgaging, buying your first home, or looking to invest, we can guide you through your options.

Inflation can erode the value of savings. We help you secure your financial future with well-structured insurance and protection strategies.

Contact us today for personalised advice and a clear path forward.

Data Source: Office for National Statistics (ONS) Read more: Consumer price inflation, UK: December 2024