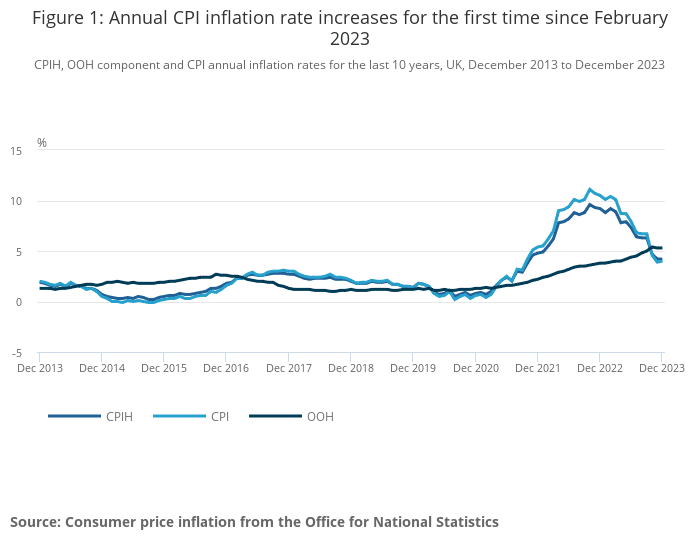

CPI inflation rate increases for the first time since February 2023

Key Points at a Glance:

- CPI: Rose slightly to 4.0% annually.

- CPIH: Remained constant at 4.2%.

- Energy Prices: Not the driving factor this time.

Inflation Overview: A Breath of Relief?

In recent months, we’ve noticed a downtrend in inflation rates – a movement that has raised a few eyebrows and questions. In the 12 months leading up to December, the Consumer Prices Index (CPI) increased by 4.0%, a slight uptick from November’s 3.9% but still down from earlier highs. Similarly, the Consumer Prices Index including Housing Costs (CPIH) held steady at 4.2%. But what does this mean for you?

Understanding the Numbers:

Delving into the ‘whys’ and ‘hows’ behind these figures is essential. Unlike previous months, energy prices have taken a backseat in influencing inflation. Instead, the increase can be partially attributed to alcohol and tobacco prices, while food and non-alcoholic beverages helped keep the rates in check.

Find out Your Options

Interest Rates and Household Economics:

Interest rates, sitting at 5.25%, also deserve attention. The Bank of England’s strategic decisions in adjusting these rates shape the terrain of inflation management, thus influencing your mortgage repayments and savings.

The recent rise in inflation is not the development that decision-makers at the Bank of England were anticipating as they contemplate future interest rate adjustments. The Bank previously increased the base interest rate 14 times consecutively until August. The rates have since been maintained at 5.25%, a strategy aimed at curbing lending and thus, reducing inflation.

Responding to today’s figures Chancellor Jeremy Hunt said:

“As we have seen in the US, France and Germany, inflation does not fall in a straight line, but our plan is working and we should stick to it. We took difficult decisions to control borrowing and are now turning a corner, so we need to stay the course we have set out, including boosting growth with more competitive tax levels.”

Moving Forward: How We Can Help

As your dedicated advisors at Kerr & Watson, we’re here to help you navigate these changes. Whether it’s reassessing your mortgage options in light of the current economic climate or reviewing your insurance and protection plans, our team is equipped to provide tailored advice.

Contact Us for Bespoke Advice

Every financial journey is unique, and we’re committed to guiding you through yours with expert advice and personalised solutions. Contact us to discuss how the latest economic changes can influence your mortgage and protection strategies.

Data Source: Office for National Statistics (ONS)

Read more: Consumer price inflation, UK: December 2023