Inflation rate holds steady in August at 2.2%

Key Points at a Glance:

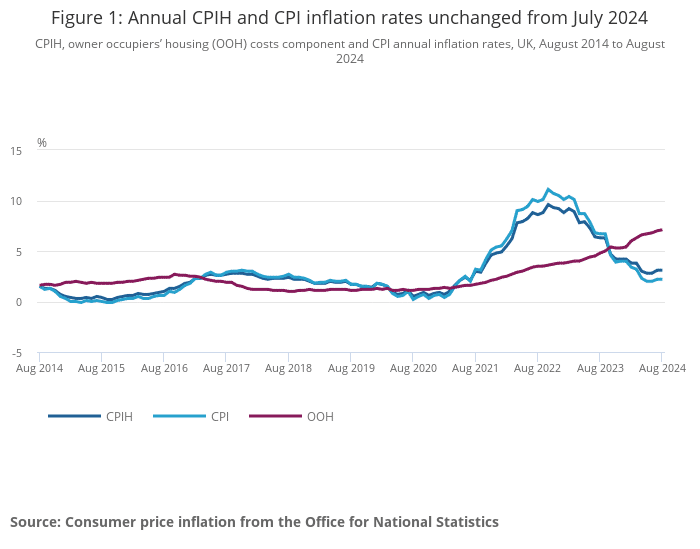

- Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 3.1% in the 12 months to August 2024, unchanged from July.

- Consumer Prices Index (CPI) also remained steady, rising by 2.2% in the 12 months to August 2024.

- Core CPIH, which excludes energy, food, alcohol, and tobacco, rose by 4.3%, up from 4.1% in July 2024.

Inflation remained unchanged for the second consecutive month, maintaining the rate seen in July 2024. The figures suggest some stability but also reveal areas of continued pressure in the economy, particularly in core services and housing-related costs.

Key Drivers of Inflation

Several factors contributed to the stability of inflation rates this month. Some sectors saw increases, while others provided downward pressure, balancing the overall inflation picture.

- Air Fares: A significant contributor to inflation, air fares rose notably by 22.2% between July and August 2024, largely due to price increases on European routes. This marks the second-largest rise in air fares between these months since 2001.

- Motor Fuels: Conversely, the drop in motor fuel prices provided a major offsetting factor. Petrol prices fell by 2.1 pence per litre, while diesel prices dropped by 2.6 pence, contributing to a 3.4% decline in motor fuel prices over the year.

- Restaurants and Hotels: The annual inflation rate in this sector eased to 4.4%, down from 4.9% in July. This is the lowest rate since July 2021, with pub and restaurant prices increasing at a slower pace.

- Owner Occupiers’ Housing Costs: A key driver of inflation within CPIH, housing costs for owner occupiers rose by 7.1%, the highest rate since 1992. This rise indicates that housing-related expenses remain a persistent source of inflationary pressure.

Historical Context

Inflation peaked at 9.6% in October 2022, driven primarily by soaring energy costs in the aftermath of the Russia-Ukraine conflict. The current inflation rates, at 3.1% for CPIH and 2.2% for CPI, represent a significant reduction from those highs. However, core inflation pressures remain, especially in the services sector.

Implications for Interest Rates

The stability in inflation figures will be a key consideration for the Bank of England as it evaluates future monetary policy. The current interest rate stands at 5.25%, and while inflation has decreased from its peak, there are indications that core inflation is still running higher than the central bank might prefer.

- Core CPIH at 4.3% reflects ongoing pressures, particularly in services, which rose to 5.9% in August.

- Wage Growth: Annual wage growth remains high, which could add to inflationary pressures if it fuels greater consumer demand. The Bank of England may opt to keep interest rates elevated to maintain control over inflation.

There is cautious speculation about whether a rate cut might occur later in the year. However, given the persistent inflation in core services, any such decision may be postponed until further reductions in core inflation are seen.

Sector-Specific Inflation Insights

- Transport: Air fares have had the most notable rise, which, along with second-hand car prices, contributed to the 1.2% rise in transport costs for the year. This is a significant increase from 0.1% in July and marks the largest rise since May 2023.

- Food and Beverages: While food price inflation has eased to 1.3%, down from 1.5% in July, the sector still contributes to overall inflation. A slowdown in food and beverage inflation has provided some relief to consumers but remains a concern for households with rising costs over the past few years.

- Clothing and Footwear: Prices for clothing and footwear rose by 1.6%, a slight decrease from previous months, but still contributing to overall inflation.

Future Outlook

While inflation has stabilised in recent months, the path forward remains uncertain. The Bank of England continues to monitor wage growth and core inflation factors, particularly in the services sector.

Key Considerations:

- Core Inflation: The rise in core CPIH indicates that while headline inflation has stabilised, underlying pressures remain.

- Housing Costs: With owner occupiers’ housing costs rising to their highest level in over 30 years, this could present challenges for homeowners and those looking to enter the housing market.

- Interest Rates: The decision on interest rates will be closely linked to inflation trends over the next few months, with any further cuts likely depending on sustained control of inflationary pressures.

Moving Forward: How We Can Help

At Kerr & Watson, we understand that inflation and economic changes can affect your financial plans. Whether you’re looking to reassess your mortgage options or review your insurance and protection plans, we are here to provide tailored advice that suits your needs.

- Mortgage Advice: With interest rates remaining high, now is a crucial time to review your mortgage options. We can help you explore remortgaging options or find deals that offer better security in the current economic climate.

- Insurance and Protection: As the cost of living continues to evolve, ensuring your insurance and protection plans are up to date is essential. We can guide you through options that provide peace of mind for you and your family.

Contact us today to discuss how the latest economic changes might affect your mortgage and protection strategies.

Data Source: Office for National Statistics (ONS) Read more: Consumer price inflation, UK: August 2024