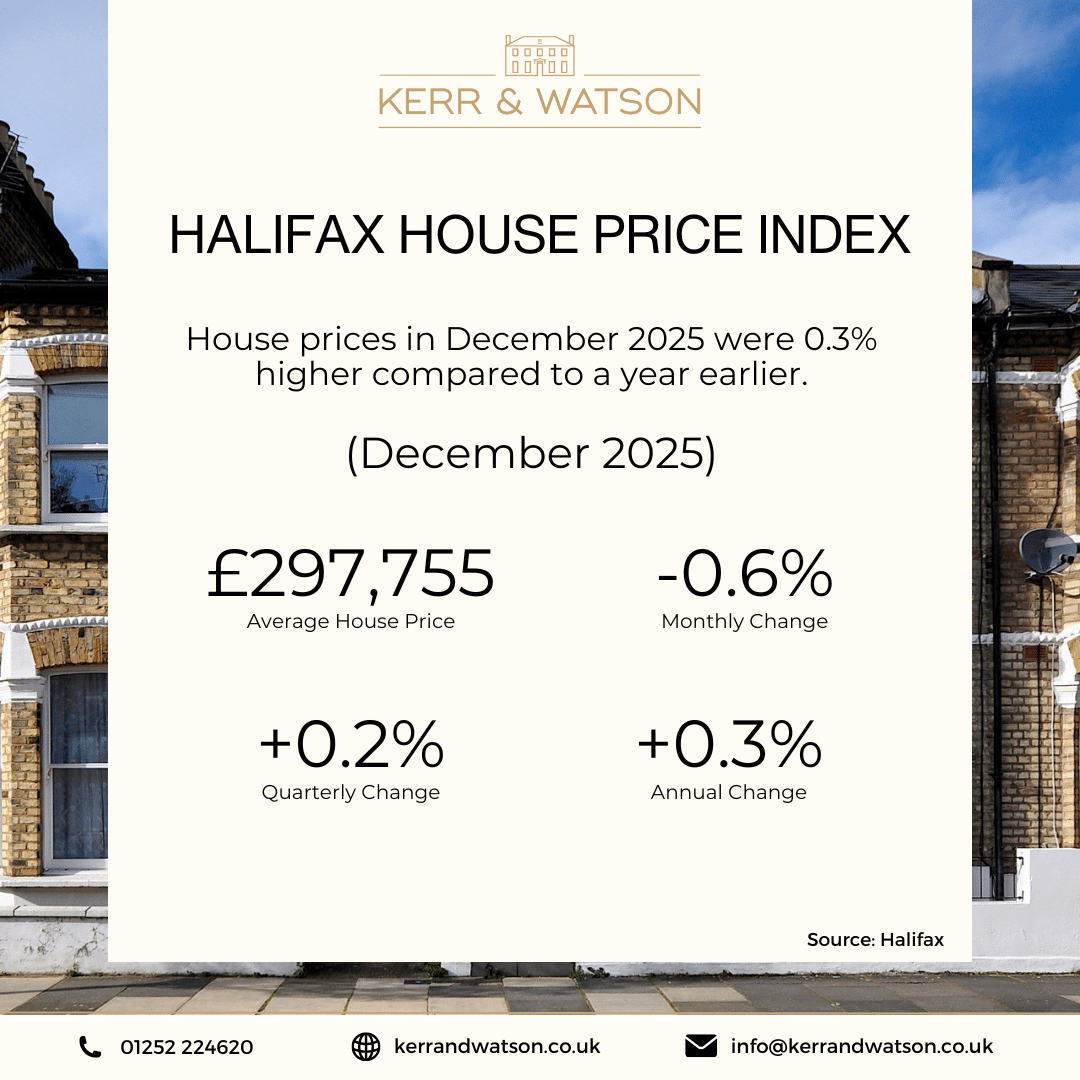

House prices in December 2025 were 0.3% higher compared to the same month a year earlier.

The latest Halifax House Price Index for December 2025 gives you a clear snapshot of how the housing market finished the year.

Prices edged down again, growth slowed, and activity remained fairly steady despite ongoing affordability pressures. If you are thinking about buying, moving home, or reviewing your mortgage in the months ahead, these figures help set the scene for what you might expect.

House prices in December 2025: the headline figures

December saw a further small dip in house prices, continuing the softer trend seen towards the end of the year.

Key figures from the latest index include:

• House prices fell by -0.6% in December, following a -0.1% fall in November

• The average property price now sits at £297,755

• This is the lowest average price recorded since June 2025

• Annual house price growth slowed to +0.3%, down from +0.6% the previous month

• Over the last three months, prices are still up slightly by +0.2%

Prices have edged down month to month, but they have not fallen sharply. On a yearly basis, values are still slightly higher than they were twelve months ago, just growing at a much slower pace.

Why did house prices fall at the end of the year?

A small fall in December is not unusual. The housing market often slows towards the end of the year as fewer people choose to move during the winter months. This seasonal slowdown was made a little more noticeable by wider uncertainty during the latter part of 2025.

According to Halifax, activity levels across the year remained fairly resilient and broadly in line with what was seen before the pandemic. That suggests the market did not stall, even though confidence softened towards the end of the year.

For you as a buyer or seller, this matters because it shows the market is cooling gently rather than correcting sharply. That usually means fewer bidding wars, more realistic pricing, and slightly more breathing space when making decisions.

What the average house price means

The current average property price of £297,755 is around £1,800 lower than in November. While that may sound significant, it represents a modest change in the context of overall property values.

For first-time buyers, small monthly falls can help ease pressure, especially when combined with improving mortgage rates. For existing homeowners, it suggests values are broadly holding steady rather than dropping away.

The key takeaway is stability. Prices are no longer rising quickly, but they are not collapsing either.

Find out Your Options

Mortgage rates and affordability: some positive signs

One of the more encouraging parts of the latest update is around affordability.

Mortgage rates have already started to reduce following the most recent Base Rate cut. Lenders are also offering a wider range of options, particularly for those borrowing at higher loan-to-value levels. This is helpful if you have a smaller deposit or are buying your first home.

Another important point is affordability compared to income. The house price to income ratio reached its lowest level in over a decade in December. That does not mean homes are cheap, but it does suggest the balance between earnings and house prices has improved compared to recent years.

If you are trying to work out whether now is the right time to buy, this combination of easing rates and stabilising prices could work in your favour.

What to expect next

Looking ahead, Halifax expects modest house price growth during 2026, in the region of 1% to 3%.

This forecast takes into account both supportive factors and ongoing challenges, including:

• Lower mortgage rates improving affordability

• More choice from lenders

• Slowing wage growth

• A flatter employment picture

For you, this suggests a market that is likely to remain fairly steady, rather than one that surges or slumps. Planning, budgeting, and getting the right advice will be more important than trying to time the market.

Regional house price performance

House price trends continue to vary depending on where you are looking to buy or already own property.

Northern Ireland remains the strongest performing area, with prices rising by +7.5% over the past year. The average home there now costs £221,062.

Scotland also saw solid growth, with average prices reaching £217,775 and annual growth of +3.9%.

In Wales, property values increased by +1.6% over the year, bringing the average price to £230,233.

Across England, performance was mixed. The North East recorded the highest annual growth, with prices up +3.5% to £181,798. The North West followed with growth of +2.8%, taking the average price to £245,323.

London was the main exception, with prices falling by -1.3% over the course of 2025. The average property price there now stands at £539,086.

These differences matter if you are relocating, investing, or weighing up whether to move now or wait. Local trends can have a bigger impact on your decision than national averages.

Housing activity and buyer demand

While prices give one part of the picture, activity levels help show how confident buyers are feeling. Recent data shows:

• Mortgage approvals for house purchases fell slightly in November by -0.7% to 64,530

• Approvals were -2.1% lower than the same time last year

• Buyer enquiries remain subdued, with fewer new buyers entering the market

• Agreed sales levels have remained broadly unchanged month to month

This points to a market where people are still buying and selling, but at a measured pace. For you, that can mean less competition and more time to make informed choices.

If you are a first-time buyer, the current market may offer more balance than you have seen in recent years. Prices are stable, mortgage options are improving, and affordability has edged in the right direction.

If you already own a home, this could be a good time to review your mortgage, especially if your deal is ending soon. Falling rates and increased lender competition may open up better options.

If you are thinking about moving, understanding local price trends and borrowing options is key. Small differences in rates or loan structure can make a big difference over time.

Getting the right advice

House price figures are useful, but they are only one part of the decision. Your income, deposit, credit profile, and future plans all matter just as much.

At Kerr & Watson, we help you make sense of the numbers and apply them to your own situation. Whether you are buying your first home, moving, or reviewing your existing mortgage, tailored advice can help you move forward with confidence.

If you would like to talk through your options or understand how the latest market changes affect you, get in touch with us for clear, straightforward mortgage and protection advice.

The full report for more insights on the current state of the UK housing market: Halifax Price Index December 2025

Source: Halifax