Knowledge

Your resource for guides, blogs, case studies and more.

Our Knowledge Hub includes easy-to-understand guides, articles, and case studies to help you understand more on mortgages and insurance. Whether you are a first-time buyer or seasoned property investor, our handy tools like mortgage calculators and a A-Z glossary are here to make things clear and simple for you.

Articles and Case studies

Stay up to date with market knowledge and the latest industry trends through our insightful articles and in-depth case studies.

Mortgage Checklists

Our checklists are designed to guide you through every step of the mortgage application process, the essentials of moving home, and what to look for when viewing properties.

Get Your Free Credit Report

Find out your credit history and score at no cost and get a clear picture of where you stand.

Residential Calculators

Calculate your borrowing potential, monthly repayments, and any associated Stamp Duty costs.

Buy to Let calculators

Calculate affordability, repayments and Stamp Duty for your buy to let property.

Life Insurance Calculator

Calculate your ideal life insurance cover with our user-friendly tool, and find out how much protection you may need for your peace of mind.

Income Protection Calculator

Not sure how much income protection cover you can get? Enter your annual income to calculate the maximum benefit available to you.

Budget Planner

Whether you’re a first-time buyer or looking to move, assessing your mortgage budget is a critical step.

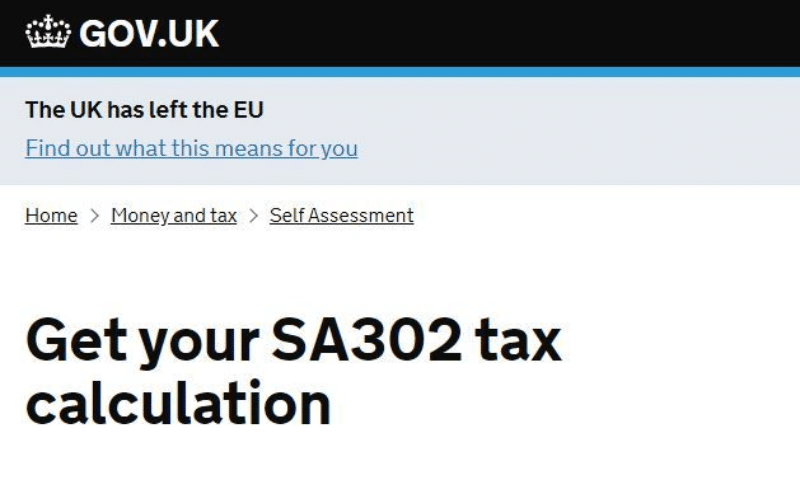

How to Get your Tax Calculations and Tax Year Overviews?

If you are self-employed or a limited company director, mortgage lenders nearly always require you to provide your SA302 (Tax Calculations) & Tax Year overviews to support and evidence the income you have earned and declared for your employed, self-employed, dividend and property related remuneration.

Find out how you can get your Tax Calculations and Tax Year Overviews.

Types of Surveys and How Much They Cost

In the process of purchasing a property, one of the crucial steps to ensure your investment’s safety is getting a house survey or valuation. Understanding the types of surveys available and their associated costs can help you make informed decisions and avoid unexpected expenses down the line.

Here’s everything you need to know about different types of surveys and their costs.

Mortgage Lenders

Find The Perfect Mortgage Lender For Your Needs.

Our extensive network includes around 200 lenders and over 5,000 mortgage products, showcasing our dedication to providing you with the widest range of options.

Insurance Providers

Find The Perfect Insurance Provider For Your Needs.

With access to the entire market, we have the capability to search and compare offerings from a vast array of Insurers, ensuring we recommend the most suitable insurance policy for you.

A-Z Mortgage And Insurance Glossary

Understand industry jargon and decode complex mortgage and insurance terms.

Local Areas

Discover nearby towns and villages for your next move.

Testimonials

Contact Us

Get A Free Consultation – Find out your options by speaking to a mortgage or insurance broker today.

By clicking on ‘Submit’, you consent to your contact details being stored by us and agree with our Privacy Policy.

Kerr & Watson | Address: Pembroke House, 8 St Christophers Pl, Farnborough GU14 0NH, UK | Phone: 01252 224620 | Email: info@kerrandwatson.co.uk | Hours: Mon-Fri 9:00–17:30