Category: Large Mortgages

-

Ultra High Net Worth Mortgage Options

UHNW Mortgages Explained: Private Bank & Asset-Backed Options In the UK, the term “Ultra High Net Worth Individual” typically refers to someone with net assets of £30 million or more, although definitions can vary slightly between financial institutions and wealth managers. This figure excludes primary residence and liabilities in some interpretations, while others include all… Read more

-

Unsecured Business Loans

Unsecured Business Loans – Fast Funding Without Using Your Assets Running a business often means needing quick access to finance. Whether you’re covering short-term expenses, investing in growth, or smoothing out cash flow, finding the right loan can make a huge difference. An unsecured business loan can help you do just that, without tying up… Read more

-

Buy to Let Mortgages with Serco Tenants

Buy to Let Mortgage Advice for Serco and Housing Association Tenants If you are a landlord exploring buy to let opportunities, you may have come across the option of leasing your property to Serco or other organisations such as housing associations and charities. This niche part of the market can be attractive due to the… Read more

-

Mortgages for Pilots

Specialised Mortgages for Pilots: Tailored Advice for Airline Professionals When it comes to securing a mortgage as a pilot, the process may feel anything but straightforward. Your income is often more complex than that of some other professions, with elements like flight allowances, bonuses, and expenses making it difficult for traditional lenders to assess your… Read more

-

What to Bring to Your Mortgage Appointment

Essential Checklist: Documents You Need for a Hassle-Free Mortgage Appointment Preparing for your mortgage appointment is crucial for a smoother and more efficient application process. Bringing or sending over the correct documents can significantly speed up the approval of your mortgage or remortgage. At Kerr & Watson, we aim to make this process as seamless… Read more

-

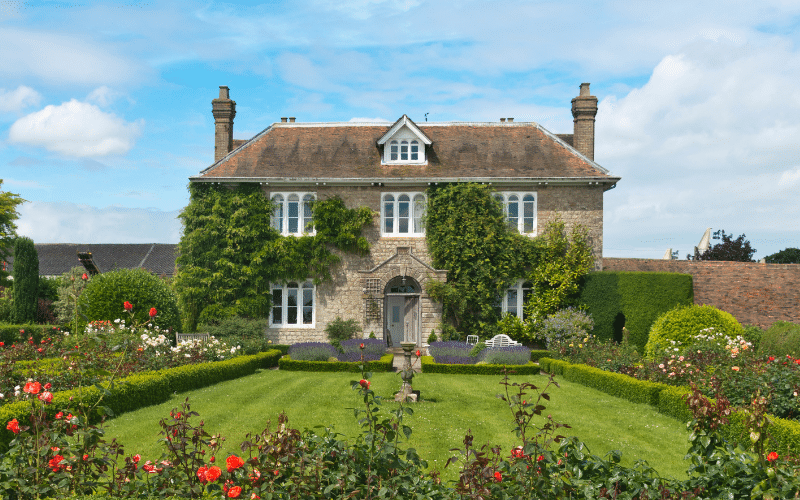

How Much Does £2 Million Pound Mortgage Cost?

Understanding the Costs of a £2 Million Mortgage Taking out a £2,000,000 mortgage is a major financial decision, and it’s essential to be aware of the expenses involved. Whether you’re a high-net-worth individual, an investor, or simply exploring the costs, this guide provides a breakdown of what to expect. At Kerr & Watson, we specialise… Read more

-

How Much Does £1 Million Pound Mortgage Cost?

What Are the Costs of a £1 Million Mortgage? Securing a million pound mortgage is a significant financial commitment, and understanding the costs involved is crucial. Whether you’re a high-net-worth individual, an investor, or simply curious about the expenses, this guide will provide an overview of what you can expect. At Kerr & Watson, we… Read more

-

How Much Does A £5 Million Pound Mortgage Cost?

Understanding the Expenses of a £5 Million Mortgage Taking on a £5,000,000 mortgage is a major financial commitment, and it’s important to be aware of the costs involved. Whether you’re an investor, a high-net-worth individual, or simply researching the financial requirements, this guide will outline what you need to know. At Kerr & Watson, we… Read more

-

The Mortgage Process: What Lenders Look For and What Underwriters Do

Key Insights and Tips to Boost Your Mortgage Approval Chances Mortgage underwriters are the gatekeepers of mortgage approval, meticulously assessing every aspect of a your financial profile. We explain the intricacies of mortgage underwriting, shedding light on what lenders scrutinise and offering actionable advice to bolster your chances of securing that coveted mortgage offer. Understanding… Read more

-

How Much Does A £4 Million Pound Mortgage Cost?

The Financial Considerations of a £4 Million Mortgage Taking out a £4,000,000 mortgage is a substantial financial decision that requires careful planning. Whether you’re a high-net-worth individual, a property investor, or simply exploring the costs, understanding the financial implications is essential. At Kerr & Watson, we specialise in expert mortgage and protection advice, ensuring that… Read more

-

Longest Term Mortgage in the UK

Longest Term Mortgage in the UK: Benefits and Drawbacks When considering a mortgage, one of the decisions you’ll face is the length of the mortgage term. The mortgage term refers to the duration over which you’ll repay your loan, influencing your monthly payments, total interest paid, and financial planning. As lenders continue to evolve their… Read more